Money is something I am VERY passionate about, so I have been looking forward to this post for a long time. There’s A LOT to consider when fundraising, so I did a lot of practical research to be able to present the most valuable information and paint a COMPLETE picture of the fundraising landscape. This is a long one, so bear with me….

So… You have an exciting new project that you want to do – a business, an art project, a dance/performance, a film, a public installation, or maybe a social experiment! But you need a BUNCH of this stuff calledmoney to pay for costumes, labor, art supplies, equipment rentals, insurance, and don’t forget to pay yourself! Films are especially expensive, requiring tens of thousands, maybe hundreds of thousands of dollars. But how the HECK do you get that kind of cash into a bank account? Do not let the concept of money intimidate you – I’ve found that getting money for a project (even hundreds of thousands of dollars) is actually a lot easier than you think. There are so many tactics and resources available to you:

Angels (rich aunt/uncle)

Pros: no liabilities, funds can come from experienced money people who love and support you, generally easy and quick

Cons: goes both ways, risk of tarnishing an important family relationship

Investors

Pros: funds usually come in large quantities

Cons: many laws and restrictions, requiring large upfront cost for securities attorney, requiring a lot of time, the money you get becomes a liability that your company must pay back

Crowdfunding

Pros: simultaneously builds your audience, no fiscal liabilities

Cons: difficult to get large quantities of money, takes a lot of time and effort to build campaign, no guarantee of hitting your goal, obligation to your audience

Sponsors

Pros: free money! no liabilities, support can often go beyond just money

Cons: usually comes with a small obligation, branding can affect your brand

Donations

Pros: free money! no liabilities, no obligations whatsoever

Cons: difficult to sell, 501(c)(3) status or fiscal sponsorship required for tax deduction

Grants

Pros: free money! can lead to additional funding in the future

Cons: difficult, competitive, not usually lucrative

Your Funding Strategy

First, let’s first figure out what course(s) of action would work best for YOUR project.... basically ALL of them. Pull out all the stops and don’t settle for less. But here are a couple pointers to help point you in the right direction: First, determine the quantity of moneys you will need by performing a very complicated, clandestine, foreign concept originally originating from a very small village in 13th century France called "budgeting." Make a list of everything you will need, but don't just guess the cost for every line item. Call a few places and get real quotes. Don't forget to pay yourself for your time, but don't be greedy either. And finally, make sure you budget a contingency of 10%–20% as it will most definitely be more expensive than you planned. After budgeting, if you realize you need less than $10,000, then you may only need to pursue the 1 or 2 avenues that you think would be easiest for your project and the network you have. But if you find that you need $10,000-$100,000, you probably need to pursue 3 different avenues. Three is a good number – anything more becomes overly complicated and difficult to manage.

Secondly, determine what other projects of the same type have done successfully by performing two ancient processes handed down through the generations from our ancient Greek ancestors called "research" and "copying." Look at what other projects of the same type have done.... Here are some suggestions. If it’s your first major project, try to find an angel first. This is the easiest course of action requiring the smallest amount of time and energy. If it’s a small-inventory product, look into crowd funding – is there a market out there of people who would want your product? If it’s an art project, dance, performance, public installation, or anything involving education, grants are a good place for that. Sponsors are great for events because they get advertising out of the deal. Any project that is culturally or socially important is the perfect venue for donations from people or organizations who believe in your cause. If it’s not your first rodeo and you’re looking for large quantities of money for a project that has a definite market and a possibility for a return, that’s exactly what investors are looking for. And people with money are VERY OFTEN looking for small-to-medium projects to be involved with just for fun and in hopes of an exciting return.

Wanna know the strategy I employed to successfully raise $222,000 for my first feature film? I used the rule of 3 by starting with investors, crowdfunding, and then some sponsorship as well. Here’s how I did it…

Pitch Packages

No matter what project you are doing, no matter who you are thinking of hitting-up for moneys, do YOURSELF a favor and create a pitch package for your project. Pitch packages are NOT just for pitching to investors, sponsors, fans, grants, etc. They help you digest your thoughts and understand what it is that you are really doing – honing-in on the specifics, streamlining your process, solidifying your strategies, etc. In other words, pitch packages MAKE your project better. Creating a pitch package is part of my creative process for every film because it helps me get rid of the stupid ideas and hone-in on what is most important. Make it visual, make it high-quality, make it impressive. Think “eighth grade science project,” and shoot for an A++.

For SHARP, we spent about $15,000 to make thirty of the sexiest pitch packages you’ve ever seen. They included a fancy full-color prospectus explaining all the most important details of the project that investors would want to know (story, genre, crew, budget, marketing, film festivals, etc.), a copy of the script, a SHARP hat, a red Cutco spatula-spreader with the SHARP logo engraved on it, a SHARP pin, a copy of the short film on DVD (another $25,000), as well as the most important paperwork: business plan, private placement memorandum, and operating agreement (all legally required documents for any business/securities offering). All of this was contained within a fancy red leatherette(just like the Cutco leatherette). Everything was of the highest quality and best presentation – it looked SHARP to say the least. I know it seems like a lot of work and expense, but you gotta put your money where your mouth is if you are trying to raise that kind of money. Trust me, this kind of showmanship pays off BIGTIME. It shows investors that you are serious and you ONLY produce high quality work. And it worked… We sent out thirty of them, got twenty responses, set ten appointments, and made six sales totaling $220,000.

Selling Sponsors…

Here’s where you get to be creative. Remember, business is an art unto itself. Do some brainstorming: what businesses, products, or brands (big or small) would look great with your project? A film about indie game developers would be a great partnership for companies like Steam and Adobe (Indie Game the Movie). A film about a man who rides a segue cross-country is the perfect film for a segue company to sponsor (10mph). An iPhone case made out of recycled plastic bags is perfect for Apple to sponsor and sell in their stores (this is an idea I have been wanting to do for a long time, feel free to steal it). A film about a morning routine is perfect for a coffee or tea company to sponsor (Coming soon…). You get the idea. Make the branding seamless so it doesn’t seem forced and turn off your audience.

Donations & Tribe-Building

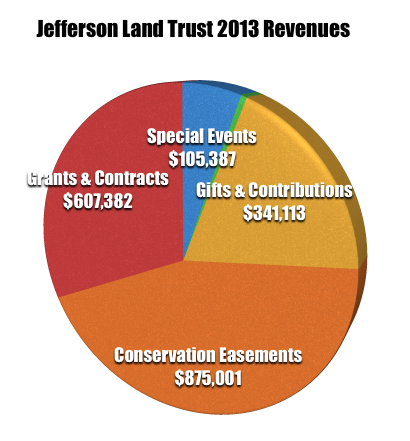

I had the unique privilege of spending an afternoon with a MASTER of fundraising. Sarah Spaeth has been directing the Jefferson Land Trust for almost twenty years. JLT has been responsible for raising over $1mil per year in donations, contributions, gifts, and grants (check out their 2013 Annual Report here). That’s EVERY YEAR – and in a small community of 30,000. In 2013, out of $1.9mil in total revenue, about $600,000 came from grants & contracts (≈30%). That means the rest came from donations, gifts, and contributions – 45% of which was in the form of land as opposed to money (≈$875,000). In total, JLT raised about $450,000 in 2013 from straight-up old-fashioned check$ – still pretty impressive.

Of course I wanted to soak up everything I could about how they do this, and Sarah was nice enough to share some of her wisdom. Surprisingly, they do very few fundraising events – only about 5% of their revenue comes from special events every year (≈$100,000). So I asked her how EXACTLY they were able to influence that much revenue year after year. It was interesting to hear that most of what she does is community-building. She said that most of the contributions come as a result of building 1-on-1 relationships through face-to-face meetings (a form of direct sales), and telling their story. Relationship-building, networking, direct sales, and storytelling – ladies and gentlemen, that’s Marketing 101 at it’s finest. Keep in mind, they do have a pretty strong mission, brand, team, leader, and an extremely valuable product that they sell: Who doesn’t want to support longterm land protection in this area? We all want to keep our beautiful trees, wildlife, rivers, and clean air. And how do you put a price on that? It is such a valuable commodity – especially today – it becomes priceless. No price is too high for something that valuable. I guess $1.9mil per year gets the job done for everybody in this area.

Since my background is in direct sales, I inquired further about the actual mechanics of selling this kind of a product through face-to-face interactions. Sarah said – in addition to their events, fundraising breakfasts, and fundraising house parties – she literally goes on coffee dates to continue to build and strengthen the relationships she has with the community (most of which are repeat customers). How many of these she goes on every year, I have no idea – probably a lot. She finds the individual community-member’s passion, whatever it may be, and shows how JLT can satisfy that want/need (Sales 101) by telling the story of what they are doing to conserve Jefferson County’s natural resources – protecting wildlife, helping return the salmon runs, purchasing important wetlands, protecting local farms, etc. Much emphasis is placed NOT on advertising and asking people to “please give us money,” but instead on creating a community who believes in what JLT believes. Or as Seth Godin puts it: “leading a tribe.”

Sarah – thank you so much for sharing your wisdom with us. You are amazing.

Click to watch Return of the River trailer

I also had a chance to speak with Jessica Plumb, co-director of Return of the River, the incredibly moving and culturally-transforming documentary about the Elwha Dam removal project right here in the Olympic Mountains – the largest conservation project in the history of the U.S. I recently visited the ex-dam-site and was lucky enough to witness the Coho Salmon returning to their spawning river run for the first time in 100 years! Jessica also has a background in fundraising for non-profs and was able to raise about $90,000 in grants and donations for the film. But she said that she found funding a film to be much different than funding a non-prof. It was easiest for Jessica to ask for donations for specific things – “We need $XXX to hire a helicopter pilot,” “We need $XXX to hire an animator to do 2min of animation,” “We need $XXX to finish the score,” etc. She calls her fundraising strategy the “three-legged-stool strategy,” raising ≈$40,000 from non-prof sponsors, ≈$12,000 from small donors and fans through a crowd funding campaign, and ≈$40,000 from large donors. They used the Northwest Film Forum in Seattle as their fiscal sponsor to accept donations, who only took 5%. Speaking of which…

Fiscal Sponsorship

Most donators will be looking for a tax deduction – that’s the whole point of a donation. In order to be able to offer a receipt that proves as a tax deduction, you need a FID or EIN number from a legitimate non-prof with 501(c)(3) status from the IRS. Unfortunately, the IRS is currently backed-up with non-prof applications for three years, so the best course of action for you and your project is to get a fiscal sponsor. Fiscal sponsors are non-profs that you use as a conduit to transact donation moneys. They’re GREAT! They handle the money for you, do all the accounting for you, and give your donator a tax-deductible receipt so you don’t have to worry about ANYTHING. And they usually only charge 5% as a fee, which is AMAZINGLY cheap. Fiscal sponsors are easy to come by – every major non-prof is used to doing fiscal sponsorship work and they all have a process for it. You probably don’t have to look any farther than your local community.

Crowdfunding

Crowdfunding is a whole ‘nother ball game. For this reason, I will be doing an entire blog post devoted just to crowdfunding, so stay tuned.

The Science of Grant-Writing

Yes, there is a science to it. These people read SO MANY submissions everyday. You gotta be clean, straightforward, clear, and stand out. I recently attended a grant-writing workshop at Goddard College, put on by Gerard Holmes, who writes grants for a living. It was very informative. Here’s what he shared:

• The government requires foundations and non-profs to give away 5% of their endowment every year – this is where most grants come from.

• Government grants are the most lucrative but also the most competitive, so it is wise to make friends with politicians because knowing a senator can greatly increase your chances of getting funding

• The IRS requires foundations to publish their 990 tax form annually – read this form to see who is on their board, how much money they're giving every year, and what they normally fund in order to better appeal to them

• If you do not have 501(c)(3) non-profit status, then you need a fiscal sponsor, who usually takes a 5% fee. More info: www.fiscalsponsors.org

• Check out cooperative collectives and grant databases to better understand the grant landscape and see what grants may apply to you: www.grantspace.org,www.grants.gov, www.guidestar.org, www.NEA.gov

• It is much easier to get grant money in other countries than in the US

• Most non-profs say "no unsolicited proposals allowed," but learn how to become solicited by…

• Find a connection you have through somebody you know, see if they're local, send frequent letters of inquiry

• They want to look like they'll fund everything, but in reality, they have a very specific idea of what they want to fund, so look at what they have funded in the past

• Here's what should be in your funding request: cover letter, proposal, budget, any attachments they ask for

• Cover letters should be as concise as possible, don't waste their time because they look at so many proposals every day, the letterhead should introduce you and who you are, the language should be business professional but friendly, own up to the fact that you are asking them for money, give them a good reason why you are asking, and most importantly, thank them

• What's in the proposal: what you intend to do, how you intend to do it, why you are uniquely qualified to do it, what you will change as a result, how you will continue your efforts after funding ends, share your beliefs and why you're doing this project, and be as short and concise as possible

• Your budget should be very clear as to how much this will cost, including salaries (≈40%), materials, and any overhead (utilities, office space, accounting etc.), how long your project will take (timeline/schedule), and where the rest of the money is coming from (matching funds, community crowdfunding, angel investors, etc.)

• Attachments at the request of the funder include: proof of nonprofit status, resumes of crew and employees, past accomplishments or work samples, letters of support from fans or other funders

• Follow up and ask for feedback – Why did you not fund me?

• Reasons not to fund you: proofreading, grammar, presentation, conciseness, do your budget numbers add up? Always under-promise and over-deliver

• So you got funding, now what? Right away thank them with a handwritten note, send them an artful photo of the activity, sign a grant agreement/contract, do the actual work you said you were going to do, report to them of the activities to set up the conversation about what the funds next, and ask for funding again again because this often leads to more funding

Everything you need to know about investing

I saved the best for last! This is the big leagues – BIG money, BIG players, BIG stakes. But first, a little history lesson… After Black Tuesday in 1929 and the ensuing Great Depression, the Securities and Exchange Commission(SEC) was created to enforce two pieces of legislation that were enacted by Congress to regulate and protect the selling of securities in the public and private markets. In the money world, a “security” is basically a tradable stock of a company that is offered for sale, usually in the form of a “unit” or “share.” Because it is now regulated, there are rules and regulations restricting how you can buy and sell securities of a company. But that’s actually a good thing – these laws are there to protect both the business owner and the investor.

I've always been fascinated by the visual ART of business and money.

Unfortunately, you can’t just have a rich aunt/uncle write you a fat check for $100,000. This would be considered “income,” and must be accounted for in your company’s taxes or else the IRS will throw a fit. The only obstacle these laws make for you and your project is KNOWING the restrictions so you don’t get fined, sued, or imprisoned! This is why it is wise to hire a securities attorney who knows what they are doing to file the proper paperwork, to form your LLC (probably no reason for your project to be INC.), and to write your private placement memorandum and operating agreement. A private placement memorandum is simply a document that describes the specifics of how your company is structured, how an investor will give you money, and how they will be paid back, according to the federal securities laws and the securities laws of whatever state your company is filed within. Our securities attorney cost us $7,000, in addition to the $15,000 for pitch packages and $25,000 for our short film.

The other things you need to know about are the restrictions placed on investors. First of all, your investors must be formally acquainted with you or the company – they can’t just be random people off the streets. However, there are ways of getting around this legality. We had every investor fill out an “investor suitability questionnaire” to acquaint us if we didn’t already know them. This document is very simply an official introduction on paper. The questionnaire qualifies the potential investor for us because there are also restrictions on who can legally invest. Depending on your state, in order for investors to legally write you a check, they must make over $300,000 per year or have over $1mil net worth. Find where these people hang out, put on some expensive clothes, and go there every Tuesday during happy hour. The other way to get around this legality is contracting a “finder.” A finder is somebody who brings you rich people. Since you know this finder and they are contracted by the company, any rich people they know are now fair game. But legally there must be a transaction between you and your finder – a normal finder’s fee is 10%. This is a nice chunk of change for doing very little work – use this as incentive to recruit people you know in the world of wealth! We had a few finders, though nothing came from them.

The last thing I’d like you to know is that California is super expensive to do business in. If you have a digital media product that will be sold nationally online, I would suggest you look into incorporating within other states that would be cheaper/better for you and your investors. Look for states with great tax breaks within your industry.

Check out our Secrets of Sales webseries

Now you’re ready to SELL! Start with a list of qualified customers, call, set appointments, take them out to lunch, show gratitude, establish a personal connection, show them your pitch package, ask yes questions, ask for the sale, leave them with a gift, follow up, answer questions, pleasant persistence, but most of all HAVE FUN. Fundraising and collecting checks should be FUN! You will get a lot of NO's, but that makes the YES's even more fun! Just imagine getting a check written to your company for $50,000 – it’s the greatest feeling in the world.

For more info on closing the sale, check out the Secrets of Sales web series we made.

Please let me know what project you are thinking of funding! Leave a comment below!

Wanna learn more? Subscribe.